Hilton Honors American Express Aspire Card Benefit Terms & Amex Assurance Disclosures (2024/05/10)

This is an archive of Hilton Honors American Express Aspire Card Benefit Terms & Amex Assurance Disclosures (Date: 2024/05/10).

For the most current Hilton Honors American Express Aspire Card Benefit Terms & Amex Assurance Disclosures, check: https://global.americanexpress.com/card-benefits/terms/hilton-aspire

Hilton Honors Bonus Points on Eligible Purchases

Hilton Honors Bonus Points earned using your Hilton Honors American Express Aspire Card:

You will receive 3 Hilton Honors Bonus Points for each dollar of eligible purchases.

You will receive 11 additional Hilton Honors Bonus Points, for a total of 14, for each dollar of eligible purchases charged directly with a property within the Hilton portfolio, including bookings and incidental charges. To receive the 11 additional Hilton Honors Bonus Points for charges made at the time of booking, the booking must be made directly through a reservation channel operated by Hilton. You can receive the 11 additional Hilton Honors Bonus Points for incidental charges made on the Hilton hotel property (including charges made at restaurants, spas, and other establishments) if those charges can be and are charged to your room and paid for with your Hilton Honors American Express Aspire Card at checkout.

You will receive 4 additional Hilton Honors Bonus Points, for a total of 7, for each dollar of eligible purchases at the following categories of merchants: restaurants located in the U.S., airfare on a scheduled flight charged directly with passenger airlines or amextravel.com (charter flights and private jet flights are excluded); and purchases directly from select major car rental companies listed at americanexpress.com/rewards-info.

To get additional Points for a restaurant purchase, the purchase must be at a restaurant located in the United States. You will NOT get additional Points for purchases made at a restaurant owned by a U.S. company but located outside the U.S. (e.g. Hard Rock Café in Paris). You also will NOT get additional Points for restaurant purchases at nightclubs, convenience stores, grocery stores, or supermarkets. You may not get additional Points for purchases at a restaurant located within another establishment (e.g. a restaurant inside a hotel, casino, or event venue). For example, purchases made at a restaurant located within a hotel may be recognized as a purchase at a hotel, not a restaurant.

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions; see HiltonHonors.com/Terms.

Eligible purchases are purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents. Hilton Honors Bonus Points you earn with your Card will be posted to your Hilton Honors account up to 12 weeks after the end of your billing period.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional Points. A purchase with a merchant will not receive additional Points if the merchant’s code is not included in a reward category. You may not receive additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for a reward category. For example, you may not receive additional Points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

Seller of Travel

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694

Hilton Honors Complimentary Diamond Status

You will receive complimentary Hilton Honors Diamond status with your Hilton Honors American Express Aspire Card. Complimentary Diamond status benefit is only available to the Basic Card Member. If your Hilton Honors American Express Aspire Card is cancelled for any reason, your complimentary Hilton Honors Diamond status provided with the Card will be cancelled. American Express reserves the right to change, modify or revoke complimentary Diamond status at any time. If your complimentary Diamond status is cancelled, you may be able to maintain your Diamond status by qualifying under the Hilton Honors Program terms. Diamond status benefits are subject to availability and vary by hotel.

For more information on Diamond status benefits or how to maintain Diamond status each year with qualifying stays, nights or Hilton Honors Base Points through the Hilton Honors Program, visit HiltonHonors.com/MemberBenefits and Hilton.com/en/hilton-honors/benefit-terms/. The Hilton Honors Program, including the benefits of Hilton Honors Membership, are subject to Hilton Honors Terms and Conditions; see Hiltonhonors.com/terms.

Hilton Honors Status Benefit Disclosure

Hilton Honors status benefits are subject to availability and vary by hotel; see Hiltonhonors.com/MemberBenefits and Hilton.com/en/hilton-honors/benefit-terms/ for additional details. The Hilton Honors Program, including the benefits of Hilton Honors Membership, are subject to Hilton Honors Terms and Conditions; see Hiltonhonors.com/terms.

Hilton Honors Annual Free Night Reward

During each year of your Card Membership, you will receive one Annual Free Night Reward from Hilton Honors. The Annual Free Night Reward will be issued in the form of a redeemable code and sent in an email from Hilton Honors to the email address listed on your Hilton Honors account. You will receive the Reward email within 8-14 weeks after your renewal month. If your account anniversary month changes (for example, due to a card replacement), your Free Night Reward will be triggered within your new renewal month and available within 8-14 weeks. This benefit is only available to the Basic Card Member on the Card Account. The Annual Free Night Reward can be redeemed for one standard accommodation, double occupancy, subject to availability at properties in the Hilton portfolio, excluding those listed at HiltonHonors.com/freenightreward. To redeem the Annual Free Night Reward, Card Members must call 1-800-446-6677 and mention the code provided by Hilton Honors. The Annual Free Night Reward expires one year from the date of issuance and must be redeemed on or before the expiration date. An Annual Free Night Reward will be forfeited if not redeemed on or before the expiration date. You are only eligible to receive the Annual Free Night Reward once per year of Card Membership, and you are only able to receive this benefit with an upgrade to the Hilton Honors Aspire Card one time.

To ensure receipt of the Reward e-mail notification, you should confirm the correct email address is listed on your Hilton Honors account profile. You can view the status of any Annual Free Night Rewards issued to you by visiting your Hilton Honors Account Dashboard at HiltonHonors.com. The Annual Free Night Reward is not transferable and may not be redeemed for cash or Hilton Honors Points. An Annual Free Night Reward may be combined with other Hilton or Free Night promotions in market and may be added to an existing paid or Reward stay. An Annual Free Night Reward includes all applicable resort fees and taxes on the cost of the room for the redeemed night at all locations except for a tourism tax at properties located in Malaysia. The Card Member is responsible for all incidental charges and, if applicable, the Malaysian tourism tax. Annual Free Night Reward redemptions may be cancelled pursuant to the Free Night Reward cancellation policy on the Hilton Honors Program website (hiltonhonors.com).

Free Night Rewards are subject to Hilton Terms and Conditions, available at https://hiltonhonors3.hilton.com/en/about/free-night-terms.html.

Hilton Honors Free Night Reward

Basic Card Members can receive a Free Night Reward from Hilton Honors after the total eligible purchases on their Hilton Honors American Express Aspire Card Account reach $30,000 or more in a calendar year. Basic Card Members can receive an additional Free Night Reward from Hilton Honors after making an additional $30,000 in purchases that year, totaling $60,000 or more in cumulative purchases in that calendar year. Each Free Night Reward will be issued in the form of a redeemable code and sent to the Basic Card Member via email from Hilton Honors to the email address listed on their Hilton Honors account. Basic Card Members will receive the Reward email within 8-12 weeks after meeting the purchase requirement(s). This benefit is only available to the Basic Card Member; however, eligible purchases made by Additional Card Members will contribute to the purchase requirement(s).

Eligible purchases to meet the purchase requirement are for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or other cash equivalents. If you transfer to a different Hilton Honors American Express Card product that also offers a Free Night Reward benefit, any eligible purchases you made on your old Card Account will count toward the new Card Account’s Free Night Reward purchase requirement, after your first transaction on the new Card Account.

The Free Night Reward can be redeemed for one standard, double occupancy accommodation, subject to availability, at properties within the Hilton portfolio, excluding those listed at HiltonHonors.com/freenightreward. To redeem the Free Night Reward, Basic Card Members must call 1-800-446-6677 and mention the code provided by Hilton Honors. A Free Night Reward expires one year from the date of issuance and must be redeemed on or before the expiration date. A Free Night Reward will be forfeited if not redeemed on or before the expiration date. To ensure receipt of the Free Night Reward e-mail notification, confirm the correct email address is listed on your Hilton Honors account profile. To view the status of any Free Night Rewards issued to you, visit your Hilton Honors Account Dashboard at HiltonHonors.com.

The Free Night Reward is not transferable and may not be redeemed for cash or Hilton Honors Points. A Free Night Reward may be combined with other Hilton or Free Night promotions in market and may be added to existing paid or Reward stays. A Free Night Reward includes all applicable resort fees and taxes assessed on the cost of the room for the redeemed night at all locations except for the tourism tax at properties located in Malaysia. The Card Member is responsible for all incidental charges and, if applicable, the Malaysian tourism tax. Free Night Reward redemptions may be cancelled pursuant to the Free Night Reward cancellation policy on the Hilton Honors Program website (hiltonhonors.com).

Free Night Rewards are subject to Hilton Terms and Conditions, available at https://hiltonhonors3.hilton.com/en/about/free-night-terms.html.

$400 Hilton Resort Credit

Basic Hilton Honors American Express Aspire Card Members can receive up to a total of $200 in statement credits semi-annually (January through June; and July through December), for up to $400 back annually for eligible purchases made directly with participating Hilton Resorts on their Card Account.

Eligible purchases must be made directly with a participating Hilton Resort and charged to a Hilton Honors American Express Aspire Card for the benefit to apply. Visit hilton.com/resorts for the list of participating Hilton Resorts. Advance Purchase Rates/Non-Refundable Rates are not eligible for the resort credit. Incidental charges (including charges made at restaurants, spas, and other establishments within the hotel property) must be charged to your room and paid for with a Hilton Honors American Express Aspire Card for the benefit to apply.

Eligible purchases can be made by both the Basic and any Additional Card Members on the Card Account. However, the total amount of statement credits for eligible purchases will not exceed $400 on the Card Account per calendar year. Please allow 8-12 weeks after the eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. Please call American Express at the number on the back of your Card if statement credits have not posted after 12 weeks from the date of purchase. To be eligible for this benefit, your Card account must not be cancelled or past due at the time of statement credit fulfillment. Statement credit(s) may not be received or may be reversed if the purchase is cancelled or modified, or if you engage in abuse or misuse in connection with the benefit.

American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, the January statement credit would be applied. American Express also relies on information provided to us by the merchant to identify eligible purchases. If American Express does not receive information that identifies your transaction as eligible for this benefit, the Basic Card Member will not receive the statement credit. For example, your purchase will not be eligible if it is not made directly with a Hilton Resort (e.g., if a purchase is made at a restaurant or convenience store within a Hilton Resort). Basic Card Members may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as eligible, if a transaction is made with an electronic wallet or through a third party (such as an app store), or if the merchant uses a mobile or wireless card reader to process it.

$200 Flight Credit

Basic Hilton Honors American Express Aspire Card Members can receive up to a total of $50 in statement credits each calendar quarter (January through March, April through June, July through September, and October through December), for up to $200 annually for eligible purchases of airfare made directly with an airline or through amextravel.com. To be eligible for this benefit, an airfare purchase must be for a scheduled flight on a passenger carrier and purchased directly from the airline or through amextravel.com.

Eligible purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages or ticketing or similar service fees, ticket cancellation or change fees, interest charges, or purchases of cash equivalents. Purchases of scheduled flights made with third party travel agents or websites may be eligible for this benefit if the airfare is charged directly to your Card account by the airline. Please visit americanexpress.com/rewards-info for more information.

Eligible purchases can be made by both the Basic and any Additional Card Members on the Card Account. However, the total amount of statement credits for eligible purchases will not exceed $200 per Card Account per calendar year. Please allow 8-12 weeks after the eligible purchase is charged to your Card Account for statement credit(s) to be posted to the Account. To receive this benefit, your Card account must not be cancelled or past due at the time of statement credit fulfillment. Statement credit(s) may not be received or may be reversed if the purchase is cancelled or modified, or if you engage in abuse or misuse in connection with the benefit.

American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, the January statement credit would be applied. American Express also relies on information provided to us by the merchant to identify eligible purchases. If American Express does not receive information that identifies your transaction as eligible for this benefit, the Basic Card Member will not receive the statement credit. For example, your purchase will not be eligible if it is not made directly with an airline or through amextravel.com (e.g. if a purchase is made through a third party travel service). Basic Card Members may not receive the statement credit if we receive inaccurate information or are otherwise unable to identify your purchase as eligible, if a transaction is made with an electronic wallet or through a third party (such as an app store), or if the merchant uses a mobile or wireless card reader to process it.

Seller of Travel

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit www.americanexpress.com/travelterms.

California CST#1022318; Washington UBI#600-469-694

$189 CLEAR Plus Credit

Basic Card Members can earn up to $189 in statement credits per calendar year when the Hilton Honors American Express Aspire Card or Additional Cards on the Account are used to pay for an annual CLEAR Plus Membership. Enrollment in CLEAR Plus is required and is subject to CLEAR’s terms and conditions. CLEAR Plus Membership automatically renews each year unless canceled and CLEAR will charge the applicable Membership fee to the Card CLEAR has on file. American Express has no control over the application and/or approval process for CLEAR, and does not have access to any information provided to CLEAR by the Card Member or by CLEAR to the Card Member. American Express has no liability regarding the CLEAR program. If a Card Member’s application is not approved by CLEAR, CLEAR will refund the charges. If the statement credit benefit has been applied before CLEAR refunds the charges, that statement credit will be reversed. Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $189 across all Cards on the Account per calendar year. For additional information on the CLEAR program, including information regarding Membership, eligibility, and for a list of participating locations, as well as the full terms and conditions of the program, please go to www.clearme.com. The CLEAR program is subject to change, and American Express has no control over those changes. Please allow up to 6-8 weeks after a qualifying CLEAR transaction is charged to the Card Account for the statement credit to be posted to the Account. American Express relies on accurate transaction data provided by the merchant to identify eligible CLEAR Plus purchases. If you do not see a credit for a qualifying purchase on your eligible Card after 8 weeks, please call the American Express number on the back of your Card. Card Members remain responsible for timely payment of all CLEAR charges. If you are assigned a new Card number or have a Card number on file with CLEAR that is outdated (for example, if you replace your Card or if your Card has expired), you must update your Card information on file with CLEAR to help ensure that statement credits are received for eligible CLEAR Plus Membership fees. To be eligible for this benefit, the Card Account must not be cancelled or past due at the time of statement credit fulfillment. For additional information, call the American Express number on the back of your Card.

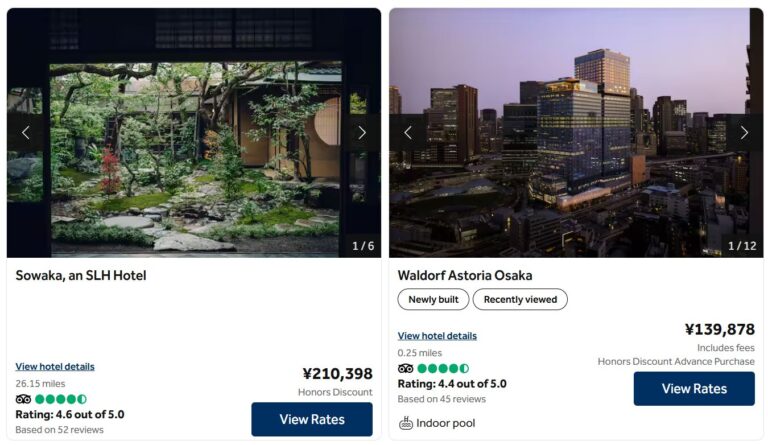

$100 Property Credit

When you use your Hilton Honors American Express Aspire Card to book through HiltonHonorsAspireCard.com or by calling Hilton Honors at (855) 292-5757, for a two-night minimum stay at Waldorf Astoria® Hotels & Resorts, and Conrad® Hotels & Resorts, you will be eligible to receive a property credit of up to $100 per booking. You must confirm you are booking a room package eligible for the $100 property credit benefit at time of booking. Please reference ZZAAP1 when booking by phone.

Card Member will receive a hotel credit equal to $1 for each dollar of qualifying charges made at the Hilton property under the Card Member’s booking, up to $100. The property credit will be applied as hotel credit on your bill at checkout (and not on your American Express billing statement). Qualifying charges do NOT include property fees, taxes, gratuities and the cost of the room. Additional exclusions based on specific hotel restrictions may also apply (including, without limitation, purchases within the hotel that are made with a third party merchant). Please see the applicable hotel front desk for details. Stays booked by either the Basic or an Additional Card Members on the eligible Card account are eligible for the $100 property credit benefit. Each booking is only eligible to receive a property credit of up to $100, regardless of the number of rooms booked. The property credit cannot be carried over to another stay, is not redeemable for cash, and expires at checkout if not used. The property credit is non-exchangeable and non-refundable and is applied in USD or equivalent in local currency based on exchange rate at time of checkout. May not be combined with other offers or programs unless indicated. Back-to-back stays within a 24-hour period at the same property are considered one stay.

Complimentary National Car Rental® Status

Basic Hilton Honors American Express Aspire Card Members are required to enroll in the National Car Rental® Emerald Club through their American Express online account to access Executive® status. Basic Hilton Honors American Express Aspire Card Members who are already enrolled in the National Car Rental Emerald Club can upgrade to Executive status by linking their Card to their Emerald Club account using the link provided on their American Express online account. Benefits of the National Car Rental Emerald Club Executive status are subject to National Car Rental® company’s terms and conditions, including age restrictions. For more information about the National Car Rental Emerald Club, visit: https://www.nationalcar.com/en/emerald-club.html. National collects a Frequent Flyer Tax Recoupment Surcharge to cover the federal tax on the cost of the miles awarded at the time of rental. Discount applies to base rate only. Taxes (including GST), other governmentally authorized or imposed surcharges, license recoupment/air tax recovery and concession recoupment fees, airport and airport facility fees, fuel, additional driver fee, one-way rental charge, and optional items are extra. Renter must meet applicable driver, and credit requirements. Advance reservation required. May not be combined with other discounts. Availability is limited. Subject to change without notice. Blackout dates may apply.

The Emerald Club and its services require a signed Master Rental Agreement on file. Emerald Aisle®, Executive Selection℠, Emerald Reserve Service® and Emerald Club Counter Service℠ are available at select locations only. Expedited counter service available at all other locations. National Car Rental, the National “flag” and Emerald Club are registered trademarks of Enterprise Holdings, Inc. All other trademarks are the property of their respective owners © 2023 National Car Rental.

Cell Phone Protection1

Coverage is provided by New Hampshire Insurance Company, an AIG Company, at no-additional-cost to Card Membership. Coverage is subject to certain terms, conditions, and limitations, including limitations on the amount of coverage. Coverage is excess of any other applicable insurance or indemnity available to you. Coverage is limited only to those amounts not covered by any other insurance or indemnity. For more information about the coverage, please see the Guide to Benefits at americanexpress.com/CPPTerms.

Concierge

American Express Concierge may perform select services at your request and on your behalf that are limited to: (i) purchasing of available event tickets, (ii) making of available dining or other reservations (which may include, for example, spa or golf), (iii) general travel-related inquiries, and (iv) shopping requests (which may include, for example, sending of flowers or gifts); in each case, as deemed reasonable by American Express. You are responsible for all purchases and associated taxes and fees (including, without limitation, shipping fees) that Concierge makes at your request and on your behalf. You acknowledge that if you make a request through Concierge: (i) American Express is placing that request on your behalf, and (ii) the goods and/or services you requested will be provided by third parties and American Express is not liable for any injury to person or property caused by such third parties or the goods and/or services requested. American Express reserves the right to note your preferences (which may include, for example, flower preferences or tee times) for servicing and marketing purposes, but is not responsible for notifying a restaurant of any food allergies or any other dietary restrictions or preferences when making dining reservations.

Global Dining Access by Resy

The Global Dining Access program (“GDA”) is a benefit available to eligible Card Members. “Eligible Card Members” are account holders of Platinum Card® or Centurion® Card from American Express, Business Platinum Card®, Business Centurion® Card from American Express, Corporate Platinum Card® or Corporate Centurion® Card from American Express, Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Reserve Business American Express Card, Hilton Honors American Express Aspire Card,

The Platinum Card® from American Express Exclusively for Morgan Stanley, The Platinum Card® from American Express Exclusively for Charles Schwab, The Platinum Card® from American Express for Goldman Sachs, and The Centurion® Card from American Express for Goldman Sachs (and any Additional Card Member(s) on their accounts). GDA may not be available for Cards issued from some countries. GDA provides eligible Card Members with (a) access to exclusive reservations, (b) Priority Notify, which allows GDA members to set notifications to be in the first group notified when tables become available before they are made available to other Resy users, and (c) access to exclusive events. GDA reservations are accessible through the Resy iOS App and Website (“Resy Sites”) and Concierge. Some features of GDA, like Priority Notify, may not be available through Concierge. To access this benefit through the Resy iOS App, you must download the Resy App; or if you already have the Resy iOS App, ensure the latest update is downloaded. When using the Resy Sites, create a Resy account or log into your existing Resy account and add your eligible Card to your Resy account. If you are assigned a new Card number, you must update the Card number in your Resy account. When you use GDA, a badge will be placed on your Resy profile, letting restaurants know that you are a member of the GDA program. Reservations are based on a first-come, first-served basis. In the event of a reservation cancellation, you will be subject to the restaurant’s cancellation policy. Generally, same-day reservations that are not booked by GDA members are released back to restaurants at certain times of day that vary across restaurant policies. American Express and Resy make no representations or warranties regarding the availability of reservations, events, and/or experiences, which shall at all times be subject to availability and the discretion of the applicable restaurant. American Express and Resy are not responsible for informing the restaurants of any dietary restrictions or for a restaurant being able to accommodate such restrictions. There is no cost to you for booking services through GDA, although you are responsible for any purchases or fees you authorize to be charged to your Card account. GDA reservations and events are intended for personal use only and cannot be resold or used for commercial purposes. By participating in the GDA program, you are accepting these GDA terms and conditions, which are in addition to and do not replace the Resy Sites’ Terms of Service. To be eligible for this benefit, your Card account must not be cancelled.

Hilton Honors Points

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions, see HiltonHonors.com/Terms.

Hilton Honors Points

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions, see HiltonHonors.com/Terms.

Hilton Honors Program & Copyright

Hilton Honors™ membership, including the earning and redemption of Points, is subject to Hilton Honors Terms & Conditions. © 2024Hilton

Hilton Honors and all trademarks of the Hilton Portfolio are owned by Hilton Domestic Operating Company Inc. or its subsidiaries.

Hilton Honors Points

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions, see HiltonHonors.com/Terms.

No Foreign Transaction Fees

American Express will not charge any foreign transaction fee on the purchases you make outside of the United States with your Card. However, there may be circumstances where ATMs or merchants charge a fee on foreign transactions.

Hilton Honors Program & Copyright

Hilton Honors™ membership, including the earning and redemption of Points, is subject to Hilton Honors Terms & Conditions. © 2024Hilton

Hilton Honors and all trademarks of the Hilton Portfolio are owned by Hilton Domestic Operating Company Inc. or its subsidiaries.

Hilton Honors Points

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions, see HiltonHonors.com/Terms.

Hilton Honors Points

Your Hilton Honors Points are subject to Hilton Honors Terms and Conditions, see HiltonHonors.com/Terms.

A qualifying rental must meet the following: The Primary Driver’s Hilton Honors number must be provided at time of reservation. The name of the member associated with the Hilton Honors number provided must match the Primary Driver’s name on the rental to qualify for mileage awards. Only one Hilton Honors member per car rental will be credited with points. Special contracted corporate or promotional rates such as employee, net tour, travel agent, group, wholesale or package rates, crew, insurance/dealer replacement or other or non-revenue rentals do not qualify for points. Multiple rentals that encompass different cars on the same or consecutive days from the same location shall be counted as a single qualifying rental even if the member checks the car in and back out during the same period.

American Express® App

iOS and Android only. See app store listings for operating system info

Amex Offers

Eligible Card Members can redeem an Amex Offer by first enrolling in the offer in their online account or in the American Express® App and then using their enrolled Card to pay. Only U.S.-issued American Express Consumer and Business Cards and registered American Express Serve® and Bluebird cards may be eligible. We may consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your eligibility to access Amex Offers. You may not be eligible to access Amex Offers if we, in our sole discretion, determine that you have previously engaged in abuse, misuse or gaming of the Amex Offers program, or any other Amex program. Offers are also available to Additional Card Members and available offers may vary for each eligible Card Member. Please review the terms of each offer for details on how to redeem. For full Program Terms, visit www.americanexpress.com/us/amexoffersterms/.

ShopRunner

Enrolling in the Benefit.

To get the free ShopRunner membership benefit compliments of American Express (the “benefit”), you must go to www.shoprunner.com/americanexpress and verify your eligibility for the benefit with an eligible Card account number and then complete the sign up for a ShopRunner membership account (“ShopRunner account”). For details on how the ShopRunner membership works, please see the ShopRunner Terms and Conditions at https://www.shoprunner.com/terms/sr/ which govern the use of your ShopRunner membership benefit. You may also be able to enroll in this benefit through access provided to ShopRunner at participating online stores or through an email provided by American Express if it has determined that you have an eligible Card. An “eligible Card” means an American Express U.S. Consumer or Small Business Credit or Charge Card that is not cancelled and that is issued to you by a U.S. banking subsidiary of American Express. Prepaid Cards and products, American Express Corporate Cards and American Express-branded Cards or account numbers issued by other financial institutions are not eligible. ShopRunner will verify with American Express the eligibility of your Card account number for the benefit.

Maintaining the Benefit.

To maintain this benefit on your ShopRunner account, you must maintain an eligible Card. The benefit may be cancelled on your ShopRunner account if you do not have an eligible Card. You can maintain only one benefit per eligible Card.

During your enrollment in the benefit, ShopRunner and American Express will verify your benefit eligibility.

Treatment of Existing ShopRunner Memberships.

If you enroll in the benefit and sign up with an existing ShopRunner account, ShopRunner will cancel the term of your existing ShopRunner account. If you paid a fee for any unused portion of the cancelled term of membership, ShopRunner will provide you with a pro rata refund for that portion in accordance with ShopRunner’s refund policy. The refund will be processed within 2-4 weeks after enrollment and will be issued to the payment method you used to pay the fee. If a portion of the cancelled term of membership was promotional or free, the free period will be cancelled by ShopRunner and forfeited by you. If you currently have a free or promotional membership on your ShopRunner account, you should consider whether to enroll in the benefit at this time.

General Terms.

An eligible Card can be used to verify eligibility for only one benefit enrollment. American Express may receive and use your personal data from ShopRunner, which may include personally identifiable information and Credit Card information, to determine eligibility and further develop features and services related to the benefit. American Express may send you emails regarding your enrollment in this benefit. Any information American Express collects from you or from ShopRunner shall be governed by the American Express Online Privacy Statement (https://www.americanexpress.com/privacy). American Express may change, modify, cancel, revoke, or terminate this benefit at any time.

You can review these Terms and Conditions at any time by visiting https://www.shoprunner.com/terms/amex/.

American Express Experiences

Offer valid in select cities. During the specified sales period, tickets are available exclusively to all American Express® Card Members. Tickets must be purchased with an American Express Card. Standard service charges apply. Offer is subject to availability. Not all seats are available and blackout dates apply. All sales final. No refunds. No exchanges. Offer may be changed or revoked at any time at the sole discretion of American Express. Some events may not be accessible to Card Members with disabilities. For more information, please visit americanexpress.com/entertainment.

American Express Early Access

Early Access tickets may be purchased by American Express® Card Members for select events and select seats, during a specified period prior to the general on-sale dates for those events. Tickets must be purchased using an American Express Card (including, for example, the American Express International Dollar Cards). Tickets are sold by and fulfilled by third party ticket sellers (not American Express), and such tickets are subject to the rules, terms and conditions, prices and fees set by the ticket seller, event promoter and/or the venue. Early Access tickets are subject to availability and supply may be limited. Not all seats may be offered; purchase limits and blackout dates may apply. Refunds, exchanges, and resale may be prohibited by the ticket seller. For more information, please visit americanexpress.com/entertainment.

Premium Global Assist® Hotline‡

While Premium Global Assist® Hotline coordination and assistance services are offered at no additional charge from American Express, Card Members may be responsible for the costs charged by third-party service providers. Premium Global Assist Hotline may provide emergency medical transportation assistance at no cost if approved and coordinated by Premium Global Assist Hotline. For full Terms and Conditions call 1-800-345-AMEX or see americanexpress.com/GAterms.

MyCredit Guide

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries

Credit score calculated based on the FICO® Score 8 model and is provided for educational purposes. American Express and other lenders may use a different FICO® Score version than FICO® Score 8, or another type of credit score altogether, and other information to make credit decisions.

Return Protection‡

Return Protection is subject to additional important terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/RPterms.

CreditSecure®

The $1 offer is for first-time CreditSecure customers only and may only be used once. Returning enrollees pay $19.99 for the first 30 days. Thereafter, you will be billed $19.99 each month. Sales tax added where applicable to all charges. For your safety and privacy, if you are an Additional Card Member, you must have your own unique American Express username and password to purchase and to access CreditSecure. For more information call 1-866-617-1893.

For full terms and conditions, please go to www.americanexpress.com/creditsecure

1Credit score calculated based on the FICO® Score 8 model. Your lender or insurer may use a different FICO® Score version than FICO® Score 8, or another type of credit score altogether. FICO® is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

2If you activate the Online Privacy Manager service, you authorize Provider (Experian) and Provider’s Agent to remove your personal information from data broker sites (“Provider’s Agent” is Experian’s third-party service provider used specifically for removal of personal information from covered sites). You acknowledge that scans involve the inputting, searching, and/or communication of your information to the third-party people finder sites in order to determine if your information is stored on or by the covered sites, and you agree to such use of your personal information. Covered people finder sites are subject to change without notice. Provider may select which people finder sites to scan and may vary such selection on a scan-by-scan basis at Provider’s sole discretion. While some removal requests will be automated on your behalf, you acknowledge that such removal requests are not automatically granted, are not guaranteed to be successfully communicated, and may not be honored by all covered sites under all circumstances and for reasons outside of Provider and/or Provider’s Agent’s control. Once you activate the Online Privacy Manager service, you will not be able to deactivate the scan, removal and monitor function.

3The Identity Theft Insurance is underwritten and administered by American Bankers Company of Florida, an Assurant Company. Please refer to the actual policies for terms, conditions, provisions and exclusions of coverage. Coverage may vary by jurisdiction. Review the Summary of Benefits here.

Send & Split®

Send & Split® is only available in the American Express® App (“Amex App”) to Card Members with an eligible Card. Eligible Cards are US-issued Basic Consumer Cards that are issued by American Express National Bank and are not cancelled. Prepaid Cards, American Express Corporate Cards, American Express Small Business Cards, American Express-branded cards or account numbers issued by other financial institutions and American Express Cards issued outside of the United States are not eligible Cards. To use Send & Split, you must first have an email address on file, enroll in Send & Split® in your American Express Online Account (“Online Account”) and open an Amex Send® stored balance account in the Amex App (“Send Account”). Send & Split allows you to: (i) send a person-to-person payment from your Send Account to Venmo and PayPal users (“Send”) and (ii) split a Card purchase (“Split”) and receive funds to your Card account as a statement credit or to your linked Venmo or PayPal account. You may use Send & Split® with an Additional consumer Card that is issued in the US by American Express National Bank and is not cancelled if you also have an eligible Card in the same Online Account and that Online Account is enrolled in Send & Split. You must have or create an account with Venmo or PayPal and link your Online Account to your PayPal or Venmo account to use Send & Split. You must add money to your Send Account from your eligible Card(s) to Send to a Venmo or PayPal recipient. The money you add will be reflected in your Send Account balance. The charge on your Card for an Add Money transaction does not earn rewards and is subject to the Card’s purchase APR. Once the Send from your Send Account is available in the recipient’s Venmo or PayPal account, you do not have the ability to cancel the transaction. There is no fee to Send to US recipients. PayPal charges a fee to Send to non-US recipients. With Split, you can split pending or posted purchases that are made with your eligible Card in your Amex App. Once you select a purchase to Split, select the contacts you want to request to Split with. You can choose to get paid back as a statement credit to your Card account (a Split credit) or to your linked Venmo or PayPal account. Split credits to your Card account apply when we receive confirmation that the Split request was completed but may take 24-36 hours to post to your Card account. You are still responsible to pay the full purchase amount charged to your Card, regardless of whether you are paid back via Split. You earn rewards for purchases that you split in the same way that you earn rewards for other purchases. Other eligibility and restrictions apply. For complete details visit americanexpress.com/sendandsplitterms to view Terms & Conditions. Send Account issued by American Express National Bank.

American Express® App

iOS and Android™ only. See app store listings for operating system info.

Send & Split®

Send & Split® is only available in the American Express® App (“Amex App”) to Card Members with an eligible Card. Eligible Cards are US-issued Basic Consumer Cards that are issued by American Express National Bank and are not cancelled. Prepaid Cards, American Express Corporate Cards, American Express Small Business Cards, American Express-branded cards or account numbers issued by other financial institutions and American Express Cards issued outside of the United States are not eligible Cards. To use Send & Split, you must first have an email address on file, enroll in Send & Split® in your American Express Online Account (“Online Account”) and open an Amex Send® stored balance account in the Amex App (“Send Account”). Send & Split allows you to: (i) send a person-to-person payment from your Send Account to Venmo and PayPal users (“Send”) and (ii) split a Card purchase (“Split”) and receive funds to your Card account as a statement credit or to your linked Venmo or PayPal account. You may use Send & Split® with an Additional consumer Card that is issued in the US by American Express National Bank and is not cancelled if you also have an eligible Card in the same Online Account and that Online Account is enrolled in Send & Split. You must have or create an account with Venmo or PayPal and link your Online Account to your PayPal or Venmo account to use Send & Split. You must add money to your Send Account from your eligible Card(s) to Send to a Venmo or PayPal recipient. The money you add will be reflected in your Send Account balance. The charge on your Card for an Add Money transaction does not earn rewards and is subject to the Card’s purchase APR. Once the Send from your Send Account is available in the recipient’s Venmo or PayPal account, you do not have the ability to cancel the transaction. There is no fee to Send to US recipients. PayPal charges a fee to Send to non-US recipients. With Split, you can split pending or posted purchases that are made with your eligible Card in your Amex App. Once you select a purchase to Split, select the contacts you want to request to Split with. You can choose to get paid back as a statement credit to your Card account (a Split credit) or to your linked Venmo or PayPal account. Split credits to your Card account apply when we receive confirmation that the Split request was completed but may take 24-36 hours to post to your Card account. You are still responsible to pay the full purchase amount charged to your Card, regardless of whether you are paid back via Split. You earn rewards for purchases that you split in the same way that you earn rewards for other purchases. Other eligibility and restrictions apply. For complete details visit americanexpress.com/sendandsplitterms to view Terms & Conditions. Send Account issued by American Express National Bank.

American Express® App

iOS and Android™ only. See app store listings for operating system info.

Trip Delay Insurance

Coverage is provided by New Hampshire Insurance Company, an AIG Company, at no-additional-cost to the Card Member. Coverage is subject to certain terms, conditions and limitations, including limitations on the amount of coverage. This benefit provides secondary coverage. For more information about the coverage, please see the Guide to Benefits at americanexpress.com/TDTerms.

Trip Cancellation and Interruption Insurance

Coverage is provided by New Hampshire Insurance Company, an AIG Company, at no-additional-cost to the Card Member. Coverage is subject to certain terms, conditions and limitations, including limitations on the amount of coverage. This benefit provides secondary coverage. For more information about the coverage, please see the Guide to Benefits at americanexpress.com/TCITerms.

Amex Carbon Emissions Tracker

Payments to Carbon Removal Projects

Eligible Card Members can sign up to make automatically recurring monthly payments to select carbon removal projects in an amount that they choose, from $5 to $100 a month. Payments will continue to be made in the amount you choose until you cancel or change the amount of future payments. You may cancel or change the amount of future payments at any time through your American Express Online Account at http://www.americanexpress.com/en-us/benefits/carbon/profile and may contact us using the telephone number on the back of your Card if you need assistance. Your payments are not charitable donations. Your payments will be made to Cloverly, Inc., a third party that will apply such payments (net of fees and charges) to retire carbon credits issued to certain for-profit carbon removal projects. American Express, Cloverly, and the organizations sponsoring carbon removal projects are not charities and receive financial benefits from payments you make. American Express does not own, control, or manage the carbon removal projects and cannot guaranty that such projects will operate as anticipated or yield any particular results or that retired carbon credits represent a unique quantity of atmospheric carbon reduced by the relevant project. Eligible Card Members are American Express Card Members who have an active US Basic Consumer or Business Credit Card issued by American Express National Bank. For complete terms of service and information about the projects, please visit http://www.americanexpress.com/en-us/benefits/carbon/.

Amex Carbon Emissions Tracker

With the Amex Carbon Emissions Tracker, eligible Card Members can track the estimated carbon emissions that may result from purchases made with their connected American Express Cards based on the dollar amount and type of merchants of the purchases. The estimates may differ from actual carbon emissions and do not reflect other purchases made without a connected Card. Eligible Card Members include American Express Card Members who have an active US Basic Consumer or Business Credit Card issued by American Express National Bank that is linked to an American Express Online Account. Eligible Card Members may connect any eligible Card to the Tracker. For full terms and information about the methodology used by the Amex Carbon Emissions Tracker, please visit http://www.americanexpress.com/en-us/benefits/carbon/.

Carbon Reduction Insights and Tips

Amex’s Carbon Reduction Insights and Tips is for informational purposes only and is not intended to provide, or be relied upon, as professional advice. While Amex strives to provide accurate, useful, and up-to-date information and advice though the service, it does not guaranty the accuracy, effectiveness, or timeliness of such information and advice. Eligible Card Members are American Express Card Members who have an active US Basic Consumer or Business Credit Card issued by American Express National Bank. For complete terms of service, please visit http://www.americanexpress.com/en-us/benefits/carbon/.

Amex Assurance Disclosures

Car Rental Loss and Damage Insurance♦

Car Rental Loss and Damage Insurance is underwritten by AMEX Assurance Company. Subject to additional terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/CRLDIterms. If You have any questions about a specific vehicle, please call Us at 1-800-338-1670, if international, collect at 1-303-273-6497.

Baggage Insurance Plan♦

Baggage Insurance Plan is underwritten by AMEX Assurance Company. Subject to additional terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/BIPterms. If You have any questions about a specific item, please call Us at 1-800-228-6855, if international, collect at 1-303-273-6498.

Extended Warranty♦

Extended Warranty is underwritten by AMEX Assurance Company. Subject to additional terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/EWterms. If You have any questions about a specific item, please call Us at 1-800-228-6855, if international, collect at 1-303-273-6498.

Purchase Protection♦

Purchase Protection is underwritten by AMEX Assurance Company. Subject to additional terms, conditions and exclusions. For full Terms and Conditions, see americanexpress.com/PPterms. If You have any questions about a specific item, please call Us at 1-800-228-6855, if international, collect at 1-303-273-6498.